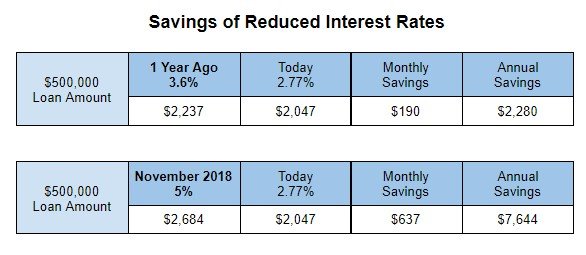

Our market, as well as many markets around the country, is currently experiencing a Black Friday type of buying experience. Buyers are able to afford houses right now that they have not been able to afford previously and and the demand for houses has increased dramatically from it. It’s not uncommon right now for buyers to be competing against thirty other offers for a home. This of course isn’t because home values have suddenly decreased, quite the contrary, one of the main contributing factors that we’d like to highlight is historically-low interest rates. These interest rates are saving people hundreds of dollars a month and allowing them to buy a more expensive home for a similar monthly payment. See what that looks like in the table below below for a loan amount of $500,000 ($625,613 is the DSF average sales price):

This environment has many buyers exhausted and defeated, but persistence is key. Much like Black Friday, this “housing sale” will not last forever. Many experts are anticipating rates to very gradually increase through the year and if buyers wait, they could potentially miss out on the housing affordability we’re currently experiencing. When that happens, we’ll finally see some relief in demand. For those with buyers currently looking, it’s essential to encourage them to persist and try and get into a home now instead of waiting for the spring/summer season, because the sale is almost over.

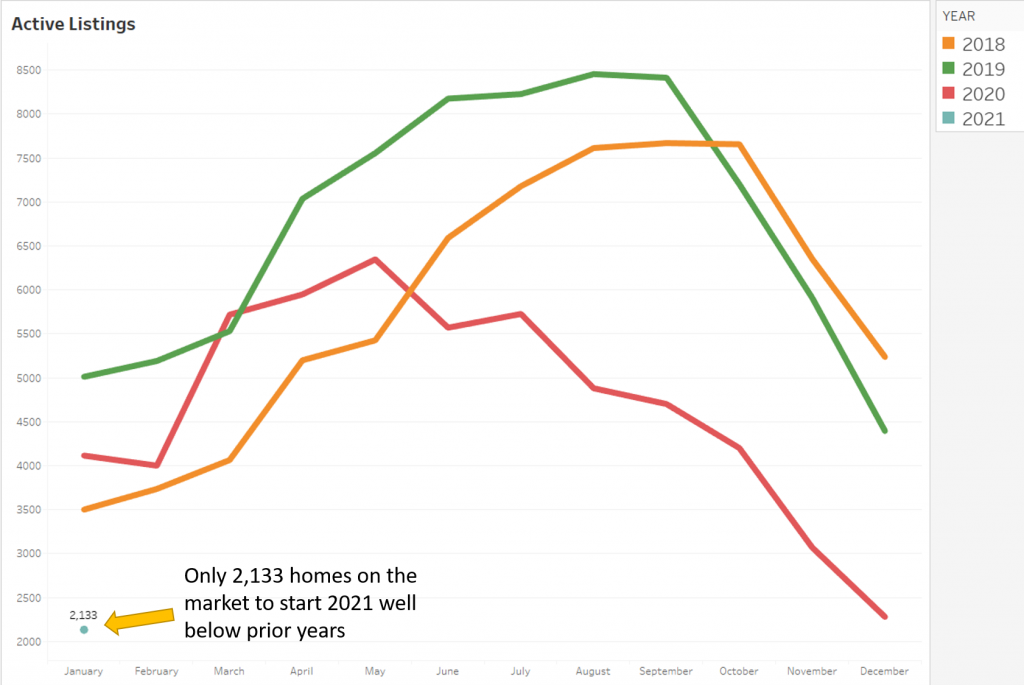

Supply – Active Listings

Active listings in January saw a – you guessed it – record low with only 2,133 homes for sale. January of 2020 was also a very low month for active listings and January of 2021 was down 48% comparatively. The combination of a very low number of new listings coming onto the market and a very high number of listings turning to pending, has likely contributed to the low number of active listings we saw in January.

- 2,133 Active Listings – Down 48% YoY

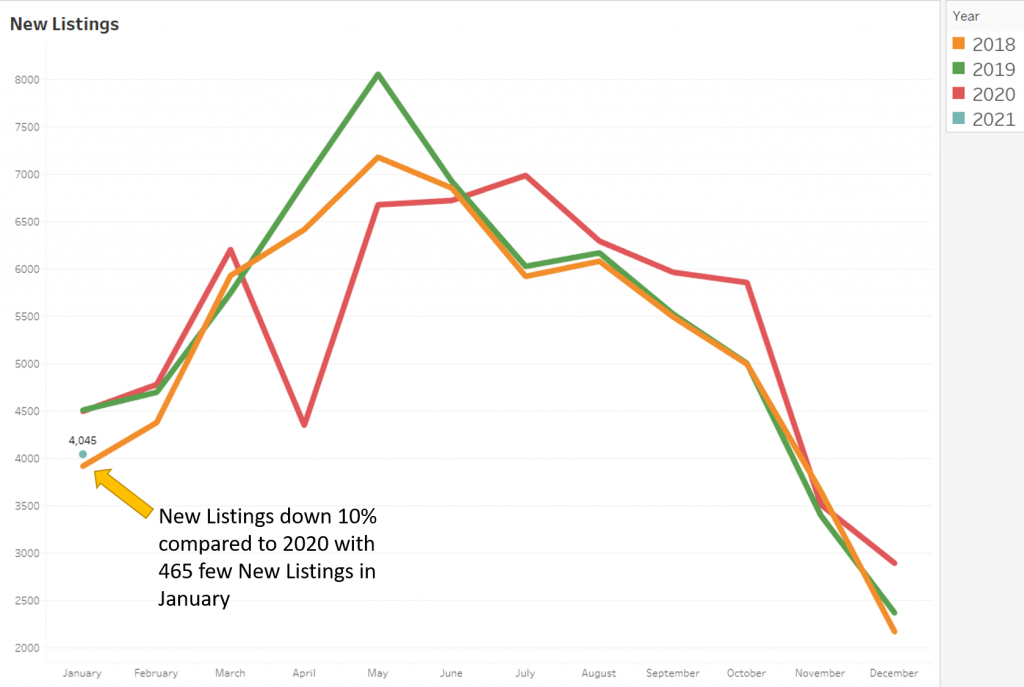

New Listings

New listings had a very slow start to the new year, down 10% year-over-year, a difference of 465 listings. In 2020, we say many new listings coming on the market, just going under contract at record speeds. This was not the case for January, as we saw the lowest number come onto the MLS in January in the past two years.

- 4,045 New Listings – Down 10% YoY

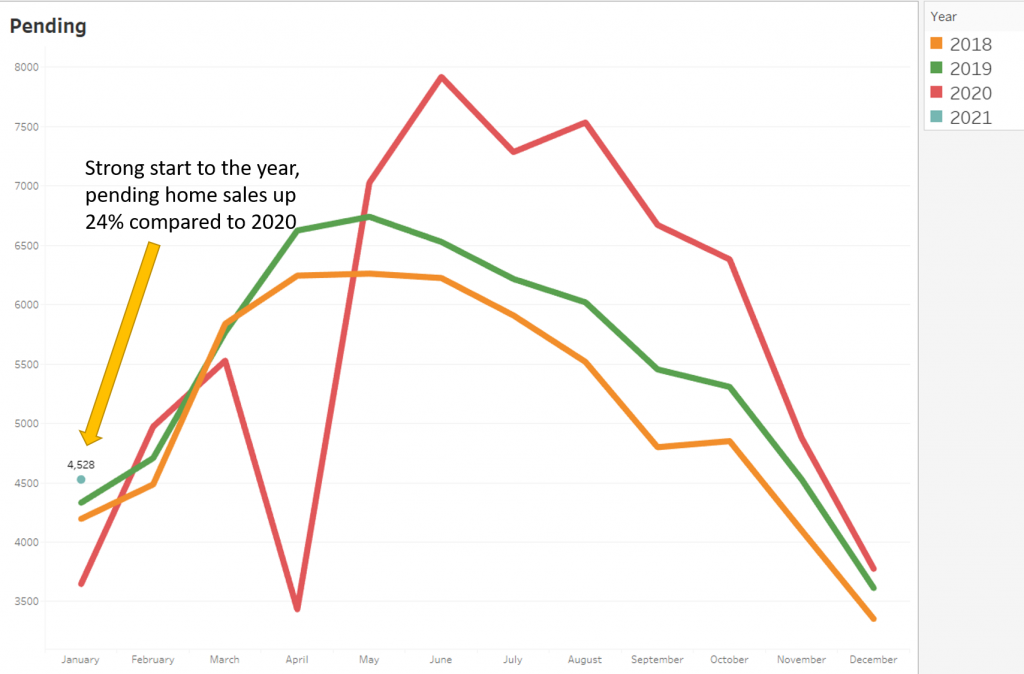

Demand – Pending Sales

January demand saw a big month for pending listed – the highest we’ve seen in the past 3 years – with 4,528 listings. As mentioned in the introduction, interest rates have been playing a big part in the increased demand in 2020 and 2021.

- 4,528 Pending – Up 24% YoY

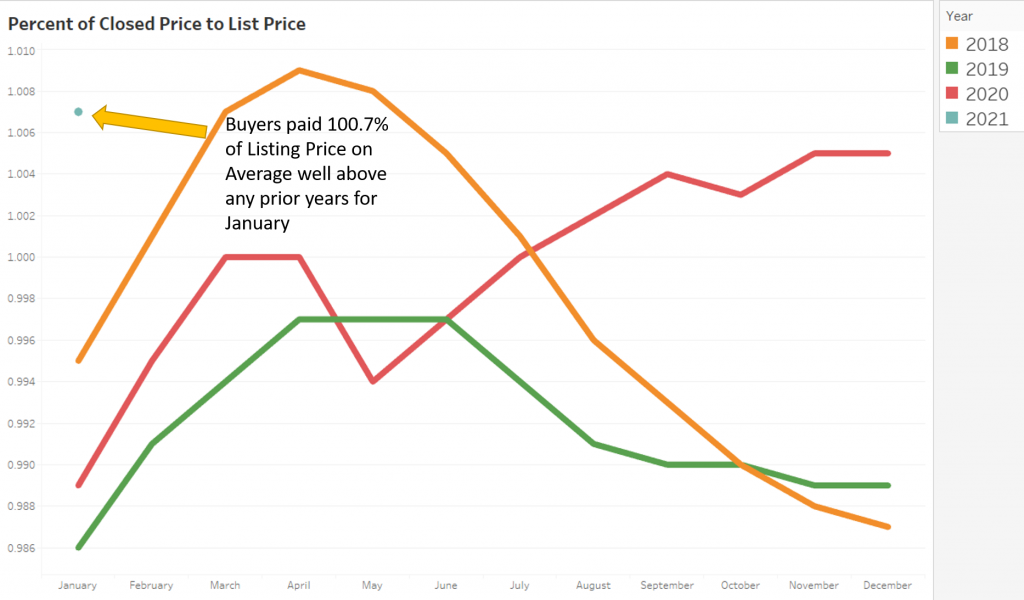

Percent of Closed to List Price

Sellers got and unheard-of 100.7% of their listing price for their final sales price in January. Typically this early in the year, we do not average over asking price but strong buyer demand has pushed us over the 100% marker already this year.

Sold Price Summary

- Single Family Average $625,613 – Up 24% YoY

- Single Family Median $507,628 – Up 13% YoY

- Condo/Townhome/Multi Average $394,456 – Up 13% YoY

- Condo/Townhome/Multi Median $332,000 – Up 10% YoY

Source: J. Renshaw / Land Title Guarantee Company